GovTrack aids Every person find out about and monitor the routines of The us Congress as well as the White Residence. Launched greater than twenty years back, we’re among the list of oldest govt transparency and accountability Sites online.

Together with offering this details towards the financial assist Neighborhood, we are modifying our units, counseling periods, publications, and Web sites to replicate the curiosity rate improvements.

For the reason that 2001 steerage was issued, the agencies have observed remarkable advancement in the volume of leveraged credit score, driven partly by desire from nonregulated buyers. The pipeline of aggressively structured commitments grew fast, and administration info methods (MIS) have been at times under satisfactory.

Numerous banks uncovered by themselves holding big pipelines of higher-hazard commitments when customer need experienced diminished appreciably. Moreover, debt agreements routinely involved characteristics that supplied restricted lender security and contained aggressive cash structures.

Pipeline administration highlights the necessity to precisely evaluate exposure on the well timed basis, the value of insurance policies and techniques that handle failed transactions and normal marketplace disruption, and the need to periodically worry check the pipeline.

The Senate in early June did not advance two bills meant to stop this imminent rise in costs. A Invoice backed by Democrats would prolong The present fascination amount for 2 yrs, and offset the expense by ending a few tax breaks.

Valuation standards focus on the significance of sound methodologies within the dedication of enterprise value (EV), the necessity to periodically revalidate the extent of assist that EV supplies, and the significance of anxiety testing EV.

Pinpointing a bank’s chance administration framework demands the specific involvement of administration and also the board in environment a financial institution’s insurance policies and its portfolio and pipeline threat boundaries.

Strain screening outlines that a financial institution need to complete anxiety testing on leveraged loans held in its portfolio in addition to These prepared for distribution.

Possibility score leveraged loans addresses a bank’s risk-ranking criteria, which really should take into account practical repayment assumptions to determine a borrower’s power to de-lever into a sustainable level within an affordable time frame. Realistic repayment is often total repayment of senior secured debt, or repayment of no less than 50 p.c of whole personal debt in excess of a five-to-seven calendar year time period.

As famous the increase-on will differ dependant upon the sort of loan and the coed’s quality level. Every single loan type also includes a most interest charge (or cap).

While this are going to be completed without any motion to the Section of faculties or the students/borrowers, the Section’s Direct Loan servicers will mail revised facts to borrowers who had been delivered fascination price information and facts dependant on the legislation before enactment of the Bipartisan University student Loan Certainty Act of 2013.

Examiners might be critically evaluating the above mentioned variables when assessing a financial institution’s possibility management more info framework, and analyzing credit classifications on leveraged borrowers.

Participations acquired describes simple considerations necessary if banking institutions purchase participations in leveraged lending transactions which includes procedures, credit approval conditions, and in-household limits that may be necessary if the financial institution were being originating the loan.

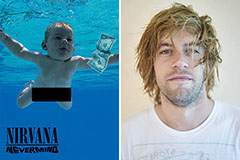

Spencer Elden Then & Now!

Spencer Elden Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!